Section 179 and What It Means for Your Small Business

November 21st, 2022 by Kevin Box

The Section 179 deduction is a valuable tax break for small and medium-sized businesses because it allows owners to deduct the entire cost of large business expenses like equipment, furniture, and machinery in a single tax season - offering significant financial relief on necessary purchases. So, if you're running a small to medium-sized business and have not heard of Section 179, you should keep reading!

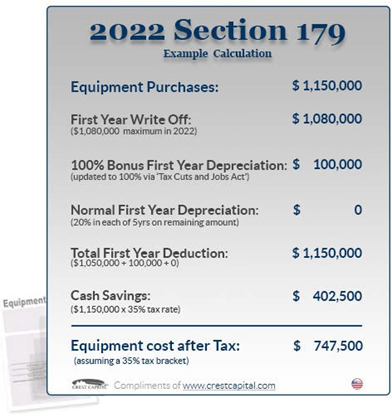

For 2022, businesses can deduct up to $1,080,000 in the cost of equipment purchased within the tax year. In addition, organizations can also obtain a 100% depreciation bonus on purchases up to $2,700,000 over and above the limit (total of $3,780,000 spending limit). To see the real impact of what the Section 179 deduction can do for an organization, look at the example calculation in the graphic on the left.

As you can see in this scenario, an organization that spends $1,150,000 would end up saving $402,500 on that expense! In addition, companies can take advantage of Section 179 on both new and used equipment. To see exactly how Section 179 will impact your bottom line this year, check out the Section 179 Deduction Calculator.

To learn more about this very compelling program for businesses, visit www.section179.org, and check out the additional FAQ section below.

Frequently Asked Questions

Q: If a company leases equipment, will that qualify for this tax break?

A: Yes! Under the current tax code, any capital or leased purchase of equipment can be applied 100% to this tax year as a deduction.

Q: If we pay to have a custom software application developed, would this qualify?

A: No. Qualified software is defined as "off-the-shelf" software that is not custom designed and is generally available to the public. Examples might be purchases of Microsoft Office or anti-virus software.

Q: How does our company claim deductions for qualified purchases?

A: Simple - just purchase or lease your equipment and complete IRS form 4562. More information can be found at https://www.section179.org/electing_section_179_deductions/.

Q: What is the period for our business to make a purchase?

A: Purchases must be made within 2022, and must be shipped/deployed by December 31, 2022.

Source: www.section179.org/section_179_deduction

Q: Would any IT hardware purchase qualify?

A: Yes! Both new and used hardware qualify this year. This includes, but is not limited to:

- Computers

- Servers

- Networking gear

- Security hardware

- MFPs and printing equipment

- IT peripherals and accessories

Q: If we utilized Section 179 last year, can we use it again in 2022?

A: Yes. The program can be used every year.

Q: What is the difference between Section 179 tax credit and bonus depreciation?

A: Bonus depreciation is only taken after the Section 179 spending cap is met ($1,080,000). This is useful to larger organizations that have made larger purchases over the course of the year.

Tax Advisory - Function4 and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Posted in: General